How We Propose to Fund This Initiative: A Sustainable Model for the Future

Funding Interest-Free Loans at a cost of around $20bn per annum to the Government

The Seed Capital for The Commons initiative is about more than just helping Kiwis buy homes—it’s about doing so in a financially responsible and sustainable way. We’ve designed a proposed funding model that draws on existing resources, reallocates government spending, and introduces new revenue streams to ensure the programme thrives without placing economic strain on future generations.

Where the Money Comes From

The core Crown expenditure in 2024 was $59bn more than in 2018. They could have funded 120,000 people every year into an interest-free loan with that increase spending.

Here’s how it could work:

State Asset Sales: We propose selling 100% of Housing New Zealand properties over 10 years, generating an estimated $4.2 billion per annum.

Sell Land Corp (Pamu), one of New Zealand's largest farmers. Many of the farms could be sold over a 10-year period.

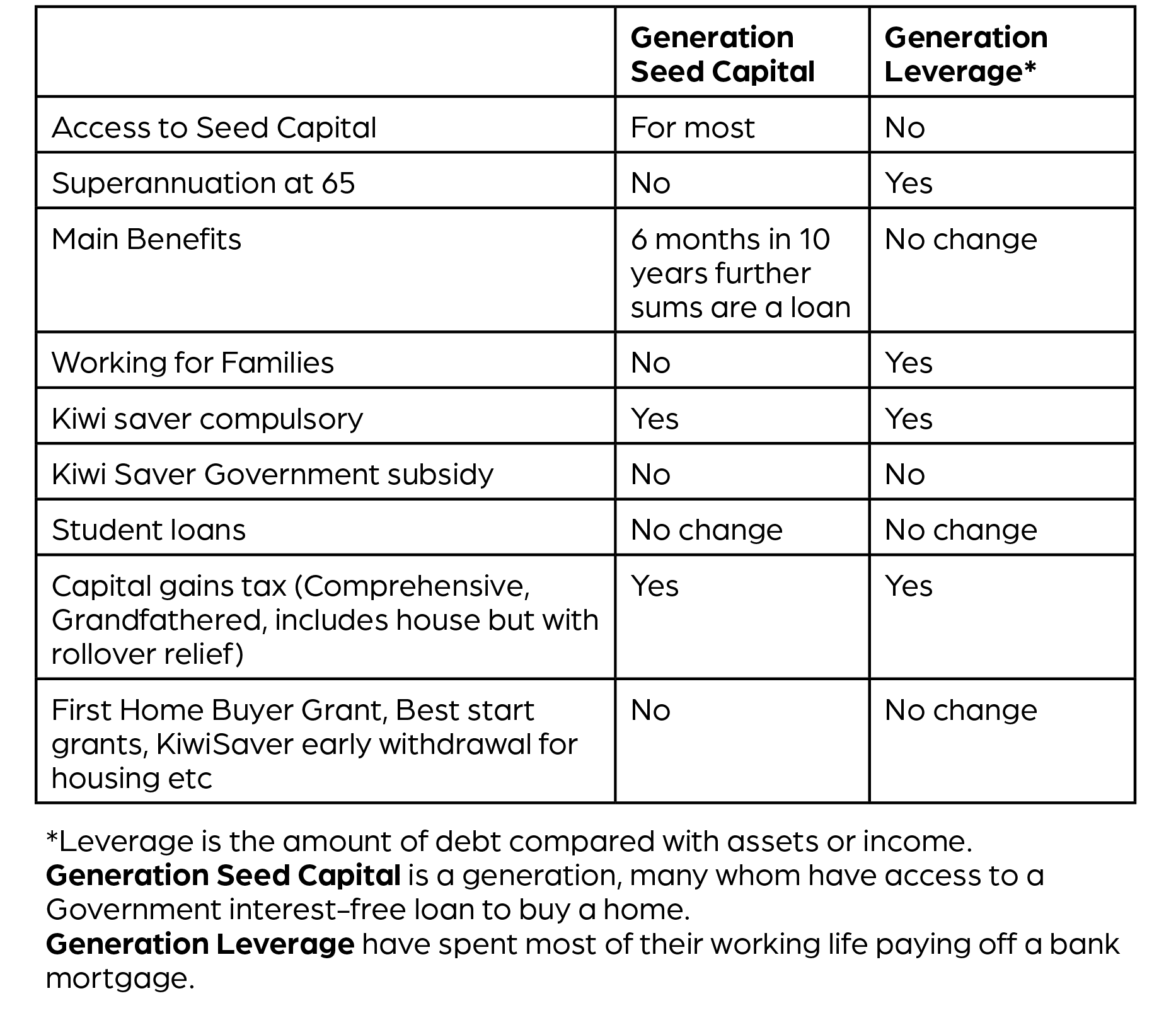

Reallocating Some Current Subsidies: Over time, spending is reduced on programmes that are no longer as necessary or effective in supporting home ownership. For example:

KiwiSaver Subsidies: The Government subsidy of $521.43 per year

Working for Families: With less cost of servicing a mortgage, there will be no need to this subsidy

Unemployment Benefit* | Domestic Purposes Benefits | Accommodation Supplement: Only available for six months in any 10-year period. If financial assistance is still required, funding will be via a loan to the recipient.

Superannuation*: No superannuation is paid after a set year (to be determined), Kiwis are required to fund their superannuation through compulsory KiwiSaver.

New Revenue Streams:

Comprehensive Capital Gains Tax

Increase the Carbon Tax: As part of our broader commitment to sustainability, a carbon tax on high-emission industries be introduced. This new tax is expected to generate $1.2 billion annually, which will be partly used to fund the interest-free loan programme

Market Biased Tax: Key person tax

Broaden the Tax Base: We also explore expanding the tax base to include previously untaxed assets and income streams, including charities. This could bring in an additional $800 million annually, ensuring the programme remains fully funded.

Borrow money: Borrowing money may be necessary in the first few years, it will eventually become self-funding.

A Sustainable Solution

Our approach is designed to become a 'normal' part of how we do things in New Zealand i.e. ACC and GST are today. The programme is amplified the longer and more consistently it runs - rethinking how the government spends on housing and social programs, we’ve created a model that ensures our interest-free loans are fully funded.

Managing Your Interest-Free Loan: Simple, Secure & Fair

How we Propose your Loan is Safe and Easy to Manage

At Seed Capital for Everyday Kiwis, we understand that buying a home is one of the most significant financial decisions Kiwis will ever make. That’s why we propose a straightforward process to ensure your interest-free loan is managed securely, with clear steps to access your funds and manage what happens if you change homes.

Getting the Money: The Role of Solicitors and IRD

When you qualify for an interest-free loan, you would work with your solicitor and the Inland Revenue Department (IRD) to ensure the loan process is seamless and transparent. Here’s how it works:

Loan Setup: After approval, your solicitor will handle the legal side of your home purchase, and the loan funds will be transferred directly to their trust account to pay for the house, just like you do for KiwiSaver funds now.

Repayments: These will happen as part of the sales process if you sell your house and do not buy another house in New Zealand. The Inland Revenue Department will advise your solicitor how much is owed as part of the sales process.

Debt Forgiveness: Easing the Burden Over Time

One of the most innovative aspects of our proposed programme is the debt forgiveness feature. After 15 years, your loan balance will start to decrease at a rate of $20,000 per year for 25 years. This gradual reduction helps ease the financial burden over time, making it possible for you to own your home outright sooner than with a traditional mortgage.

Selling Your Home

If you decide to sell your home before the loan is fully repaid or forgiven, the outstanding loan amount will need to be paid back when the sale is completed, if you buy another house in New Zealand, and you can roll over the balance to your new home.

The Comparison Table